Unlock Your Business’s Full Potential with

Leading Real Estate Tokenization Experts

Turn your real estate assets into liquid opportunities with our blockchain expert and tokenization solutions. Fortune favors the bold, so embrace this opportunity for liquidity and growth with our expert team!

Overcoming Challenges in

Real Estate Tokenization

Navigating Legal Frameworks for Successful Tokenization

Legal and Regulatory Challenges

Ensuring compliance with diverse legal and regulatory frameworks is crucial for successful tokenization.

Financial and Investment Concerns

Addressing investor apprehensions and establishing trust are key to securing funding and participation.

Technical and Technological Issues

Implementing robust, secure, and scalable blockchain technology is essential for smooth operations.

Operational and Market Dynamics

Navigating the complexities of market fluctuations and operational logistics is vital for maintaining stability.

General Perceptions and Adoption

Educating stakeholders and promoting the benefits of tokenization can help drive broader acceptance and adoption.

Ethical and Social Considerations

Maintaining ethical standards and considering social impacts are important for sustainable tokenization practices.

Benefits of Real Estate Tokenization Platform

Discover the advantages of leveraging our

Real Estate Tokenization Platform

Fractionalization

Unlock opportunities for fractional ownership, allowing investors to own a portion of high-value properties.

Efficient Asset Management

Streamline the management of real estate assets through digital tokens, enhancing transparency and accessibility.

Flexibility

Gain flexibility in real estate investment strategies with customizable token options that suit diverse investor needs.

Reduced Settlement Period

Accelerate property transactions with faster settlement times, minimizing delays and optimizing liquidity.

Reduced Fraudulent Activities

Enhance security and trust with transparent transactions on a secure blockchain network, reducing the risk of fraudulent activities.

Increased Liquidity

Improve market liquidity by enabling the easy buying and selling of property tokens, making real estate investments more accessible and fluid.

Types of Real Estate Tokenization

Based on the type of property and your specific needs,

our tokenization services can be customized into the following categories

Commercial Real Estate Tokenization

Turn your commercial real estate into secure and profitable digital tokens. Our real estate tokenization company ensures your properties are fully audited and legally compliant, ready to offer as tokenized real estate to your customers

Residential Real Estate Tokenization

Our residential real estate tokenization platform lets you and your customers easily buy, own, and trade top residential properties like houses, villas, and penthouses worldwide, earning significant capital gains and dividends.

Assets Tokenization

We can create a custom asset tokenization platform for your customers and investors to easily convert physical or digital assets into tradable blockchain tokens. Contact us for real estate tokenization services.

Checklist for Tokenization Your Real Estate Property

Decentralized & Smart Contracts

Implement decentralized solutions and smart contracts for secure transactions.

Security Audits

Conduct thorough security audits to ensure the integrity of the tokenization process.

Assets Type

Define the types of assets available for tokenization.

Ratio of Tokenization

Determine the proportion of the asset to be tokenized.

Platform Development

Develop a robust platform to facilitate token transactions and management.

Mortgages on the Asset

Include mortgage arrangements as part of the tokenized asset offerings.

Find Borderless Market

Identify and access international markets for tokenized assets.

Legal Entity

Establish a legal entity to manage the tokenized assets.

% Interest or ROI Type

Specify the interest rate or type of return on investment for token holders.

Legal & Regulatory Framework

Ensure compliance with relevant legal and regulatory standards.

Traceability

Maintain the ability to trace the history and ownership of tokenized assets.

Location of the Assets

Specify the geographic location of the tokenized assets.

Automated KYC / AML

Implement automated Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures.

Accredited Investor Verification

Verify the accreditation status of investors.

Let’s Our Experts Help you

Transform Your Bricks into Bytes

Explore the power of real estate tokenization.

Schedule your discovery call and start investing smarter.

Features of Real Estate Tokenization Platform

- Secured User Onboarding

Smooth and secure registration process.

- Legal Compliance

KYC/KYB, AML, and KYT integrated for legal adherence.

- Trading Options

P2P and OTC trading capabilities.

- Custodian and Insurance

Ensures trust with integrated custodian and insurance services.

- Payment Flexibility

Supports fiat and crypto payments.

- Investor Returns

Provides ROI and dividends to investors.

- User-Friendly Interface

Intuitive design for easy navigation and use.

- Smart Contract Management

Efficient handling and automation of smart contracts.

- KYC/AML Compliance

Robust compliance with KYC and AML regulations.

- Token Creation Tools

Easy-to-use tools for creating and managing tokens.

- Asset Management System

Comprehensive management of tokenized assets.

- Investment Tracking

Real-time tracking of investments and performance.

- Secure Payment Processing

Safe and reliable processing of payments.

- Reporting and Analytics

Detailed reports and analytics for informed decision-making.

- Token Listing and Trading

Seamless listing and trading of tokens.

- Investor Relationship Management

Efficient management of investor relations.

- Multiple Language Support

Supports multiple languages for global accessibility.

- Mobile Compatibility

Optimized for mobile devices for on-the-go access.

- Portfolio Management

Effective management of investor portfolios.

Real Estate Development Platforms

redSwan

TokenizedGreen

BlockMosaic is a platform that allows you to tokenize various real-world assets, creating a diverse and connected token ecosystem.

BlockMoaic

Check Out Related Web

Services

Check Out Frequently Asked

Questions

Real Estate Software Development Page FAQs

Key Points:

- Definition: Converting real estate assets into digital tokens on a blockchain.

- Function: Allows fractional ownership, easier trading, and increased liquidity.

- Example: A $10 million property could be divided into 1 million tokens, each worth $10.

Benefits Include:

- Increased Liquidity: Easier to buy and sell property shares on the blockchain.

- Fractional Ownership: Enables smaller investors to own a portion of high-value properties.

- Global Accessibility: Attracts international investors and expands market reach.

- Reduced Transaction Costs: Lower fees compared to traditional real estate transactions.

- Transparent Transactions: Blockchain technology ensures transparency and immutability.

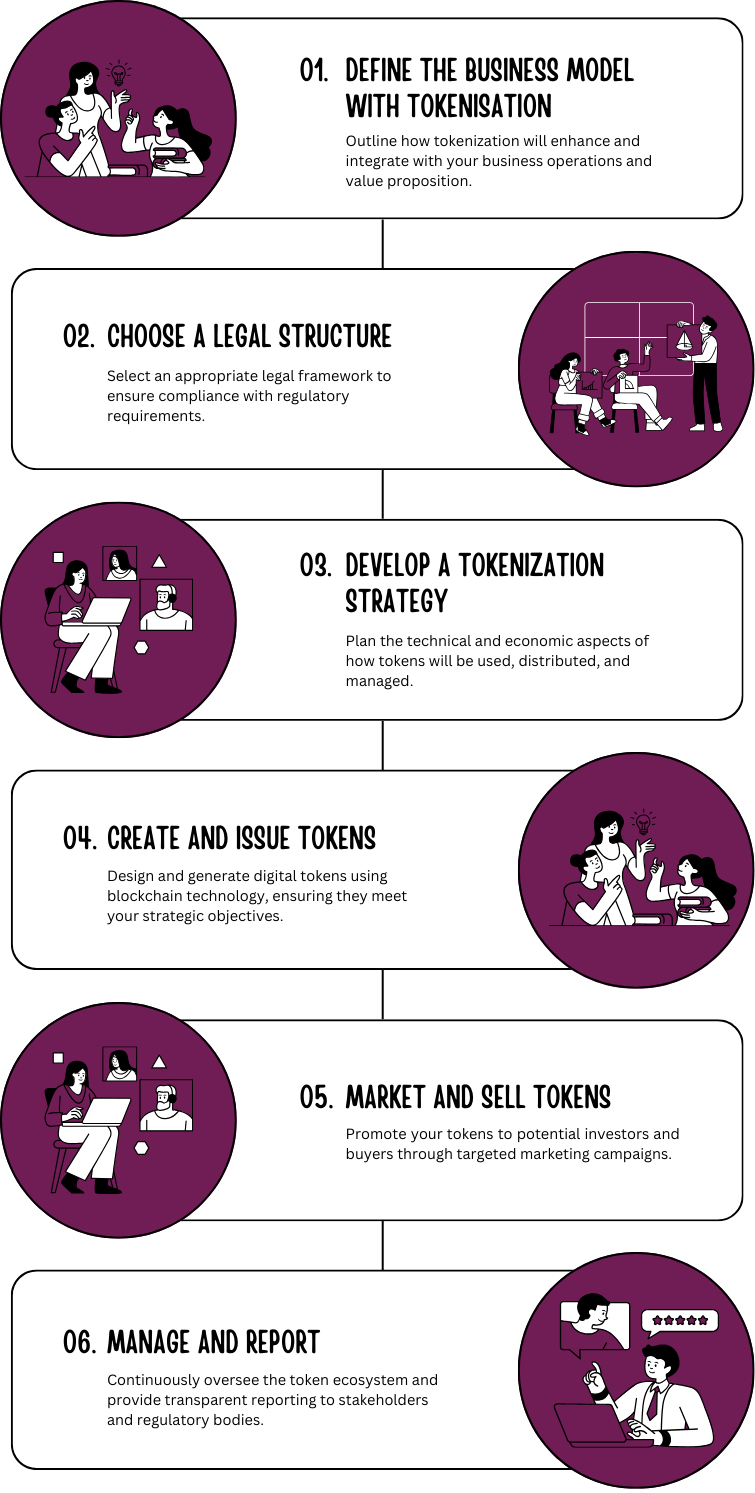

Steps in the Process:

- Deal Structuring: Define the asset, legal structure, and investment terms.

- Token Creation: Develop tokens using blockchain technology to represent shares in the property.

- Compliance and KYC: Ensure regulatory compliance and verify investor identities.

- Token Distribution: Sell tokens to investors through a secure platform.

- Asset Management: Oversee property operations, maintenance, and financial reporting.

- Trading and Liquidity: Facilitate token trading on secondary markets and manage liquidity.

Key Considerations:

- Securities Regulations: Ensure tokens are compliant with securities laws.

- KYC/AML Requirements: Verify investor identities and prevent fraud.

- Tax Implications: Understand the tax treatment of token transactions and income.

- Legal Structures: Establish appropriate legal entities like SPVs or REITs.

Technologies Used:

- Blockchain Platforms: Ethereum, Binance Smart Chain, Polkadot for token issuance.

- Smart Contracts: Automated agreements for managing tokens and transactions.

- Wallets: Digital wallets for storing and managing tokens.

- APIs: For integration with third-party services and applications.

How to Buy and Trade Tokens:

- Purchase Tokens: Buy tokens during an Initial Coin Offering (ICO) or through a token sale on a platform.

- Trade Tokens: Sell or trade tokens on secondary markets or exchanges.

- Wallet Management: Use digital wallets to manage and store tokens.

Risks Include:

- Market Volatility: Fluctuations in token value can affect investment returns.

- Regulatory Uncertainty: Changes in regulations can impact tokenized assets.

- Technological Risks: Security vulnerabilities and platform issues.

- Liquidity Risks: Challenges in buying or selling tokens on secondary markets.

Typical Costs:

- Legal Fees: For regulatory compliance and legal documentation.

- Development Costs: For creating smart contracts and blockchain infrastructure.

- Platform Fees: Charges for using tokenization platforms and exchanges.

- Marketing Costs: To promote the token sale and attract investors.

Key Differences:

- Tokenization: Uses blockchain for digital tokens and online transactions.

- Fractional Ownership: Traditional methods like partnerships or REITs for dividing ownership.

Types of Properties:

- Residential: Single-family homes, apartments.

- Commercial: Office buildings, retail spaces.

- Industrial: Warehouses, manufacturing facilities.

Smart Contracts Use:

- Token Issuance: Automates the creation and distribution of tokens.

- Transaction Management: Executes buy/sell orders and manages token ownership.

- Compliance Checks: Ensures KYC/AML requirements are met.

Global Investment Support:

- Fractional Ownership: Lowers investment thresholds for global investors.

- Cross-Border Transactions: Enables international investment opportunities.

- Accessibility: Online platforms allow easy access for global users.

Role of Regulatory Bodies:

- Setting Guidelines: Establish rules for token issuance and management.

- Ensuring Compliance: Monitor adherence to securities regulations and KYC/AML laws.

- Investor Protection: Implement measures to safeguard investor interests.

Value Determination:

- Property Appraisal: Assessment of the real estate asset’s market value.

- Market Conditions: Supply and demand dynamics in the real estate market.

- Token Sale Terms: Pricing strategy and investment terms during the token sale.

Future Outlook:

- Increased Adoption: More real estate assets will be tokenized.

- Technological Advancements: Improved blockchain solutions and smart contracts.

- Regulatory Developments: Clearer regulations and global standards.

Ready To Start a Project?

Fill the Form Below

Website is hacked by Mohammed Ali Kurban

Website is hacked by Mohammed Ali Kurban